The State of the Drone Industry 2025: Efficiency Takes Flight Across Energy and Industry

/The global drone industry is growing up—and growing smarter. According to the new Global State of Drones 2025 report from Drone Industry Insights, this year’s data paints a picture of an industry that’s maturing past its early experimental phase and increasingly focusing on delivering measurable impact.

With responses from 768 companies across 87 countries, this eighth annual survey offers a look at how drones are creating value—and where the industry is still fighting turbulence. Here’s a summary of the findings, and you can download the full report on the Drone Industry Insights website.

From Safety to Speed: Efficiency Rules the Sky

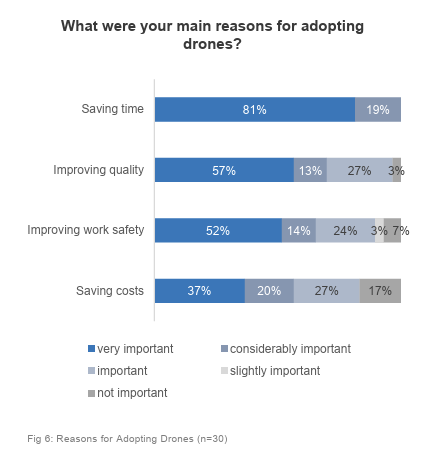

For the first time, “saving time” has overtaken “improving work safety” as the top reason companies use drones. That’s a significant shift, and one that reflects growing confidence in drone reliability and data integration.

From Global State of Drones 2025 report

In sectors like energy and utilities, where drones are now routine tools for asset inspection, this change underscores a maturing approach. Drones aren’t just keeping people out of dangerous situations—they’re streamlining workflows, cutting field time, and accelerating decision-making.

Mapping and surveying remain the leading applications (35%), followed by inspection (26%). These are cornerstones of industrial operations like pipeline monitoring, wind turbine inspection, and solar array mapping. Meanwhile, the report shows rising adoption in spraying, delivery, and localization—signs that automation is expanding beyond data collection toward actionable autonomy.

Optimism, But with Caution

The survey’s “Expectations vs. Reality” index shows that while optimism remains high, the gap between expectations and outcomes continues to widen. Software providers are the biggest winners, with expectations for the next year hitting an impressive 8.0 out of 10, suggesting confidence in analytics and AI-driven solutions that integrate with drones.

For industrial operators, that aligns with ongoing trends: data integration, digital twins, and predictive analytics are fueling demand for drone software that turns imagery into insights.

By contrast, engineering and integration firms—often responsible for custom drone systems in specialized industrial environments—saw their outlook fall below average, reflecting tighter funding and a shift toward off-the-shelf solutions that can scale faster.

Regulation Still the Biggest Roadblock

Regulatory obstacles top the list of industry challenges. From complex certification processes to restrictions on beyond visual line of sight (BVLOS) flights, the pace of rulemaking continues to shape how and where industrial drone programs can operate.

In the U.S., the much-anticipated FAA Part 108 proposal aims to simplify BVLOS approvals by aligning with international standards and allowing more industry-led risk assessment. But for now, operators in energy and infrastructure must still navigate a patchwork of waivers, keeping operational scalability out of reach for many.

Interestingly, rule-making authorities are also the top “market-driving actors,” with 61% of companies citing regulators as the biggest force defining their future. In other words: the same agencies slowing progress are also setting the pace of innovation.

Funding and Client Acquisition Tighten

Access to capital is another emerging headwind. After peaking in 2021, drone investment has cooled, leaving many service providers and hardware startups scrambling for new funding sources. This squeeze is especially visible among Drone Service Providers (DSPs), which prioritize marketing and sales (35%) but also list funding and staffing as growing concerns.

For industrial and energy clients, this could mean fewer boutique service firms and a shift toward consolidated, enterprise-scale partnerships capable of delivering consistent performance across multiple sites or regions.

A Maturing Market, Ready for Scale

Despite regulatory hurdles and tighter capital, the overall tone of the Global State of Drones 2025 report is optimistic. Market expectations continue to climb, even as the industry acknowledges the challenges of scale, compliance, and capital.

For energy and industrial operators, this signals a crucial moment. Drones are no longer “nice to have.” They’re an integral part of asset management, safety, and operational efficiency. The next phase of growth will depend on smarter regulation, stronger funding channels, and continued innovation in data-driven automation.

The full Global State of Drones 2025 report is available to download from Drone Industry Insights.